Introduction: CEO Fit Isn’t Just Cultural—It’s Strategic

In private equity, a CEO’s success is measured not just by charisma or leadership style but by their ability to translate the investment thesis into results—quickly and predictably. That’s why defining success before a CEO even steps into the role is critical.

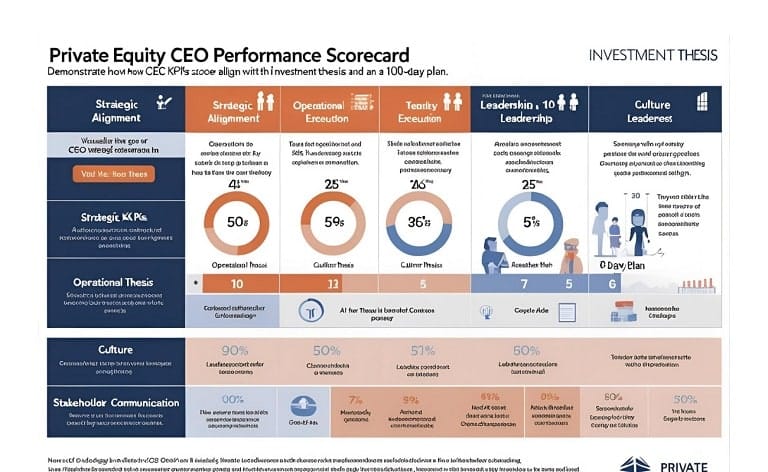

The answer lies in designing private equity CEO performance scorecards that align tightly with your fund’s goals, portfolio strategy, and the company’s 100-day roadmap.

This article provides a practical guide to creating that alignment—bridging investment theory with operational execution.

Securing the right leader to meet these strategic demands is where a specialized Chief Executive Officer search firm excels. Such a firm understands the nuances of private equity, ensuring candidates are aligned with the investment thesis from day one.

Step 1: Start with the Investment Thesis

Every PE investment is made with a thesis—be it margin expansion, geographic expansion, pricing optimization, or M&A. The CEO scorecard should mirror this thesis exactly.

Ask:

- What are the three core levers for value creation in this business?

- What does “success” look like by Year 1, Year 2, and exit?

- Which functional areas (sales, operations, finance, product) will be most critical?

By aligning CEO KPIs with the private equity investment thesis, you’re not just hiring a great operator—you’re hiring the right operator for the playbook you plan to run.

Step 2: Define the First 100 Days in Metrics

The first 100 days are make-or-break for any newly appointed PE-backed CEO. To avoid drift or ambiguity, develop CEO 100-day plan metrics that are:

- Specific

- Measurable

- Aligned with ownership expectations

Examples include:

- Conducting a full org diagnostic and talent gap assessment

- Delivering a revised budget and forecast within 60 days

- Implementing a new performance dashboard

- Completing customer listening tours with top 10 clients

These early deliverables build momentum and signal to the board and team that leadership is clear, fast, and focused.

Step 3: Build the Scorecard Using the “4 Quadrant” Model

A robust CEO scorecard typically spans four key dimensions:

- Strategic Alignment

- Execution of 100-day plan

- Progress on value-creation initiatives

- Strategy refresh and board alignment

- Operational Execution

- Revenue growth, EBITDA margin, working capital improvements

- Key hires or talent upgrades

- Implementation of reporting and analytics systems

- Leadership & Culture

- Retention of key executives

- Org health and engagement

- Ability to lead change and build buy-in

- Stakeholder Communication

- Quality and cadence of board updates

- Relationships with lenders, partners, major customers

- Transparency and accountability

This structure ensures you’re measuring CEO success in private equity-backed companies across both quantitative and qualitative lenses.

Step 4: Calibrate for Stage and Sector

What works for a growth-stage SaaS CEO doesn’t work for a carve-out industrial CEO. Tailor your scorecard to:

- Growth vs transformation vs turnaround

- Founder-led vs institutionalized companies

- Sector-specific benchmarks and maturity curves

It’s also essential to align compensation incentives with the scorecard. Bonus targets and equity grants should reward what the scorecard measures—not generic year-over-year improvements.

Step 5: Make the Scorecard a Living Document

Too many scorecards become shelfware. Instead, use them as value creation driven CEO performance frameworks that evolve quarterly based on results.

Review them:

- In every board meeting

- During CEO performance reviews

- As part of annual bonus and equity discussions

- Before any major capital planning or hiring freeze decisions

When the scorecard becomes a shared language between CEO and board, it builds trust, reduces friction, and keeps all eyes on the exit prize.

Conclusion: Scorecards Drive Outcomes, Not Just Accountability

Hiring the right CEO is half the battle. The other half is equipping them with a clear definition of success—aligned to what you, the investor, actually care about.

At JRG Partners, we help private equity firms design CEO scorecards that align with the investment thesis and 100-day plan—ensuring every new leader is engineered for execution, not just aspiration. Finding a chief executive who can execute the value creation plan is a unique challenge, making the choice of a CEO search firm for portfolio companies a critical investment decision.

Need help developing a customized CEO scorecard for your next portfolio hire? Let’s talk. JRG Partners specializes in building performance blueprints that drive results, fast.”